Tuesday, September 30th, 2014

A Q&A With Christopher Wilson, BNP Media’s Business Dev. Manager

FOLIO STAFF

Publishers today are creating custom campaigns that are driving new and lucrative business for them. One of the key successes in these campaigns is incorporating the right blend of customization and standardization.

Here, FOLIO: catches up with Christopher Wilson from BNP Media, to find out how its custom ad campaigns are driving sales. Christopher will be discussing the topic in-depth at MediaNext, Oct. 20-22.

FOLIO: What's the most successful custom ad program BNP has created in the last 6 months? What made it work?

Christopher Wilson: Our Interactive Product Spotlights (IPSs) have become a marketing game changer and one of our most successful custom ad programs to date (Ed. note: Click the image above to see an example of the IPS technology Wilson is talking about). The core idea was to create a custom offering that doesn't feel like a typical ad to readers –one that gives them a better way to engage and interact with an advertiser's brand and products– and puts them in control of how a message is explored.

Each custom IPS deliverable is created through the Ceros design studio by our in-house custom publishing team. An advertiser supplies us with their preexisting marketing collateral (ads, brochures, photos, videos, supporting non-commercial content) that we then reformat and design into the interactive HTML5 Ceros media format, along with subtle animations and interactive functionality. The end result is a really cool brand or product engagement experience. It's then promoted to a BNP Media brand audience through a lead-generating multi-platform campaign.

One of the greatest benefits of the IPS program is that we're combining custom publishing with market-specific promotion. This means that once the BNP campaigning concludes, sponsors still have a unique deliverable to market on their own or re-market through BNP Media. Another benefit to sponsors is that they can embed the IPS directly onto their website to generate inbound traffic. We're also finding that many customers are even using their IPS as a selling tool for sales calls and tradeshows.

FOLIO: So what makes the IPS program work for BNP?

CW: There are two things that really make the IPS program work for us: new publishing technology and our creative staff.

If it weren't for Ceros, we wouldn't be able to create such dynamic interactive experiences. This is a brand new way for our audiences to interact with media, making it a win-win for both sponsors and readers. And we've only uncovered the tip of the interactive publishing iceberg; you'll be seeing some awesome new media come out of BNP Media later this year including interactive articles and eBooks.

Then there's our staff. From concept development to production to design, interactive media publishing requires a great deal of creativity. To take on IPSs, our custom publishing team had to jettison the traditional publishing mindset and replace it with one that anticipates reader interactions and integrates logical calls-to-action.

FOLIO: How would you define the right mix of both standardization and customization for an ad product?

CW: I think the right mix is intimate to every individual brand within a publishing organization. At BNP Media, we have more than 50 brands catering to 11 distinct industry markets. By design, every new ad product starts out as a universal concept that can be systematically launched across all brands using our preexisting infrastructure.

The level of customization is a reflection of each brand. Prior to going to market, each brand team is presented the new product as a universal and viable concept. They are also made aware of key areas of potential customization. It's the individual brands that add a manageable level of customization to the product to suit its advertisers, its audience and its staff and editorial resources.

FOLIO: What are the most important factors in creating a native ad program that is focused on a target audience?

CW: There's that word…native. The single most important factor for creating a native program is that it is designed with the target audience in mind. Cookie cutter native programs often lack foresight and can quickly harm a brand's editorial integrity and lose the trust of its audience.

First, brands that are implementing native programs should predetermine how much, if any, editorial involvement they should have in developing content with sponsors. For instance, there are plenty of great examples of co-written native ad content (content produced by both brand editors and the advertising company), but while this model works well for some media companies, it doesn't fit the editorial mold of the majority of BNP Media's brands.

Brands should also define rules and guidelines for native content submissions and not hesitate to turn down sponsor-written content that isn't up to par. At BNP Media, our brand editors review all native ad content submissions prior to publishing. If editorial guidelines haven't been followed, we'll communicate back to the sponsor the exact reasoning behind the rejection and offer them the opportunity to revise. This isn't meant to be restrictive, but rather to provide them and our audiences the best possible opportunity to engage with each other.

Finally, brands should determine how the sponsored content is going to be presented to its audience. This requires establishing native advertising branding guidelines for all media channels included in the campaigning.

FOLIO: What are some obstacles BNP has ran into when creating these ad products for mobile?

CW: From mobile apps to native apps to mobile-friendly eNewsletters and everything in between, the biggest challenge with mobile is that it adds a new layer of complexity to our internal workflow processes and to our vendor relationships.

Our approach to launching new mobile products is pretty methodical. We'll identify the steps that need to be taken for implementation and then follow these steps to test launch the product on one of our brands. Through this process we're able to identify and document any unanticipated workflow disruptions that emerge for both brand staff (editors and production managers) as well as internal support staff (IT).

This process also allows us to fix any technology-related issues that arise, such as: "the image isn't showing up like it's suppose to." It's not uncommon during the planning and test launch phase for our technology vendors to directly collaborate with one another to provide a solution for our needs.

Once the test launch has been completed and we've refined our workflow process and set up new checks and balances, we then begin rolling out the new product across the remainder of our brands.

All of the obstacles we face are a necessary evil, though. Our internal market research indicates that more than 65 percent of our digital media is being accessed using a mobile device.

Wednesday, September 24th, 2014

A Q&A With Sarah McConville, Harvard Business Review’s VP of Marketing.

FOLIO STAFF

Smart media companies have figured out how to continuously pull in revenue from some of their oldest content—sometimes going back over a hundred years. Whether it's paid-tier memberships, ecommerce or mixing and matching topics to build new revenue streams, monetizing your archives is key.

Here, FOLIO: catches up with Sarah McConville, VP of marketing for Harvard Business Review, to find out what the most important factors are to monetizing digital content and archives. McConville will be discussing the topic in-depth at MediaNext, Oct. 20-22.

FOLIO: What's the most important component to monetizing digital content? Delivery, technology, optimization, other?

Sarah McConville: HBR tackles this by starting with audience need. What does the customer value and what is their willingness to pay for what they value? The value question can take you in a number of directions: It could be access-in multiple formats, on multiple devices, early previews, the ability to connect with others. It could be curation-if you have a large archive, helping the reader find exactly what they want, by topic, by author, etc. is important. It could be utility-managing, storing, sharing content can be valuable. And targeting and personalization-getting the right content to the right audience segment and doing that consistently and accurately can increase value and monetization of the content.

If you have a strong value proposition, you have a strong position for monetization. Technology enables delivery, optimization, access, which should also increase engagement. And from the advertiser perspective, high engagement with the right audience segment is a key part of our value equation.

FOLIO: What are some hurdles to overcome in selling subscriptions/paid-tier memberships in the digital market?

SM: There can be a temptation to load up a subscription with elements that the audience doesn't necessarily value. They aren't going to pay more for a bundle of things they don't want. Understanding your audience, and the differences within your audience segments, is essential to determining what a higher tier, or premium subscription should look like for your brand.

Digital has the benefit of allowing you to experiment and test your way into tiered subscriptions. You can look at the relationship of registration and paywalls to subscription conversion; you can experiment with different content formats or topic areas to see what resonates with your audience.

It's also important to consider the relationship of your print and digital offerings. Are they complementary or is digital a substitute for your print publication? Are you enhancing the value of print with additional elements or access in a digital subscription and does your audience recognize this? If you aren't optimizing each format for what it does best it will be tough making the case to your audience why they should step up to a tiered offer.

FOLIO: What's the biggest success Harvard Business Review has seen from capitalizing on old content to produce new revenue streams?

FOLIO: What's the biggest success Harvard Business Review has seen from capitalizing on old content to produce new revenue streams?

SM: HBR's content archive, which goes back more than a quarter century and has more than 4,000 articles, is incredibly valuable to our audience. In response to subscriber research a few years ago, we made the decision to include the archive in our "All Access" subscription and it proved to be a wise choice. "All Access" quickly became our most popular subscription offer and it's an important factor in why people renew.

We've monetized the archive in products, too. We curated the archive into lines of paperback books: HBR's Must Reads, HBR Guides, and most recently The 20 Minute Manager Series. We sell these books globally in English language and translated editions, and digitally on licensed content platforms. They are a significant revenue source for HBR Press, our book publishing arm. Collectively, these books have sold millions of units. We sell the collections in e-book form on our website as well and in some cases will enhance them with digital content.

FOLIO: How can companies combine digital and print brands in this sense?

SM: Identify opportunities for creating complements, not substitutes. Understand the relationship print has to digital and vice versa. And in person too, as many brands extend their reach through events. Know when and why your audience is engaging with a particular format and strive to make it the best possible experience for that format. If there's a consistent value proposition across print and digital, your audience will readily engage with you along the continuum-in short-form social media to apps to online to print.

You might have different teams developing different formats because the skillsets are different, but there should be a consistent editorial perspective and voice and a shared understanding of the audience across print and digital. Editorial consistency and knowledge of the audience are essential in optimizing print and digital brands together.

Monday, September 22nd, 2014

JEFFREY S. LITVACK

Established print media brands are facing unprecedented pressures to innovate and reinvent themselves; failure to do so may mean these institutions will become future HBS case studies (and not the good kind).

In real dollars terms, Newspapers are generating the same amount of advertising dollars as they did in 1950 (having lost more than $45B in print advertising). That's not to say they aren't innovating, in fact, they've created $5B in new revenue through digital advertising. But the need to innovate faster is a real necessity.

The challenge is how to innovate at the speed of the digital economy when our systems, employees and processes are all set-up for a print production cycle (think days, weeks or months). In my experience it begins with adopting a simple operating philosophy centered around one word -"iterate."

Whatever you do, don't try to come up with THE solution, but rather set up an iterative innovation around the notion of advancing the cause, rather than solving the big problem. Too often, I walk into a room where the team is discussing all the reasons why they shouldn't do something, rather than focusing on just doing it, breaking it down and managing through the next steps. My experience has shown me that if you want to move more quickly, the way to do so is through lots of smaller steps rather than trying something monumental.

Often, in product development, this begins by building a simple prototype of the idea. Nothing sophisticated or grandiose, just something visual that everyone can understand and latch on to and build upon.

AP Mobile started with this prototype approach. It began in a room of technology and business naysayers ("we tried mobile before and it failed"), and disbelievers ("the industry will never work together"). We "ignored" them and pressed on building a simple prototype of the product in a few weeks. We then flew out to Apple and demonstrated this prototype and left with developer keys in hand and a few months later the team was standing on stage with Steve Jobs introducing the first iPhone app for the news industry. A company that had never had a B2C presence, today, has tens of millions of subscribers getting breaking news directly through the AP Mobile app.

Innovation in publishing is hard to do and a constant uphill battle. But if your battle charge is "Iterate or Die", you'll find yourself winning battle after battle and eventually the tides of the war will change for the better.

Wednesday, September 10th, 2014

BY CAYSEY WELTON

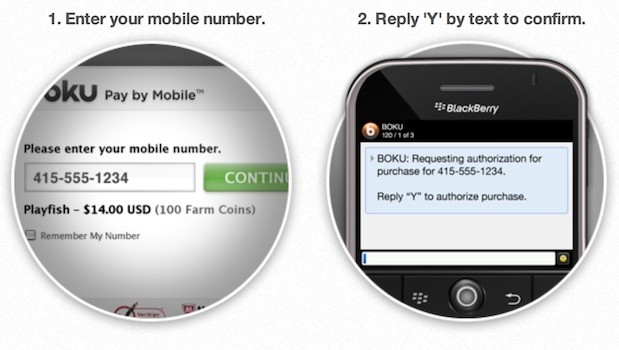

Time Inc.'s IPC Media are testing a new subscription conversion method with SMS text messaging for InStyle and Marie Claire. The objective is to develop a new touch point for millennial readers.

The solution is offered through a partnership between Boku Inc. and IPC Media. The process is pretty simple; through SMS subscribers can follow a link to a registration page. Once complete, a user's phone carrier will pick up the charges and add it to his or hers' monthly bill.

Text-to-pay will be rolled out in a number of ways, from ecommerce to doctor visits, but Time Inc. is testing it early and the developers see a lot of upside for magazine brands.

"Working with IPC Media to create such a simple, elegant solution for people to easily subscribe to their favorite magazines paves the way for ‘text-to-pay' solutions for a variety of subscription based products. Our vision of using carrier based mobile payments in the physical world has come into its own," Jon Prideaux, CEO of Boku says in a statement.

Monday, September 8th, 2014

BY SAMANTHA WOOD

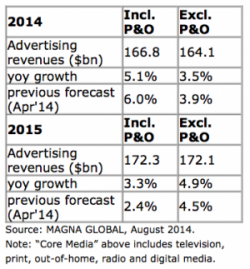

Magna Global has released its forecast for advertising revenue, predicting that U.S. media owners' ad revenues will grow by 5.1 percent this year, to $167 billion. This predicted level of growth will be the highest in 10 years, and will bring the U.S. ad market to a new all-time high of $172 billion.

Magna Global has released its forecast for advertising revenue, predicting that U.S. media owners' ad revenues will grow by 5.1 percent this year, to $167 billion. This predicted level of growth will be the highest in 10 years, and will bring the U.S. ad market to a new all-time high of $172 billion.

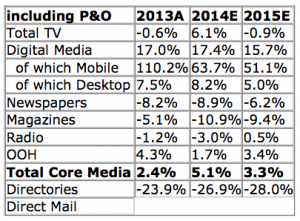

Magazine ad sales are predicted to continue to decline, with -10.9 percent expected by the end of 2014 and -9.4 percent in 2015.

The forecast for 2015 has increased to +3.3 percent from the previous +2.4 percent. With the effect of political and Olympic ad campaigns excluded, the forecast reaches +4.9 percent.

Market growth slowed significantly in 2014 with most traditional media flat or down when considering year-over-year after a strong first quarter. However, Magna Global says that second quarter "softness was mostly circumstantial and stronger advertising spending growth should resume in 3Q and 4Q," according to the report.

Television was among the categories most affected by the second quarter slowdown, but digital media is forecast to grow by 17.4 percent this year. Specifically, mobile ad sales are predicted to grow by 64 percent, versus +8 percent desktop-based advertising. According to Magna Global, digital media will reach a 34 percent market share in 2015, driven by a 32 percent growth in social and +51 percent in mobile. Digital media is expected to outgrow television by 2017 with a 38 percent market share of $72 billion.

Television was among the categories most affected by the second quarter slowdown, but digital media is forecast to grow by 17.4 percent this year. Specifically, mobile ad sales are predicted to grow by 64 percent, versus +8 percent desktop-based advertising. According to Magna Global, digital media will reach a 34 percent market share in 2015, driven by a 32 percent growth in social and +51 percent in mobile. Digital media is expected to outgrow television by 2017 with a 38 percent market share of $72 billion.

Saturday, September 6th, 2014

BY MIKE KISSEBERTH

Digital advertising spend will hit nearly $140 billion this year. And as is typically the case with any industry growing rapidly, new innovations drive growth. In digital advertising, the rise of programmatic, in particular, has become a key innovation that continues to shape today's digital advertising-scape.

According to a recent study conducted by my company, Purch, where we surveyed high-level U.S. marketer and agency advertising decision makers spending $1 million or more on digital advertising, 78 percent confirmed their use of programmatic across campaigns. Yet, while programmatic has been widely embraced, views on its uses and benefits displayed by agencies, advertisers, and publishers are not necessarily at a consensus.

The importance of good metrics cannot be underscored enough when it comes understanding the effectiveness of a strategy and which of its underlying components do and do not work. But to what end do advertisers employ programmatic campaigns and how is their success measured?

According to our study, a vast majority of respondents (75 percent) say they measure their programmatic campaigns based on sales/conversion rates. This is sensible given the constant push for ROI. However, programmatic advertisers also included brand lift (51 percent) and reach (23 percent) among their top evaluation metrics, as well. Meaning that programmatic is being used and can be deployed to fulfill various advertising needs effectively.

When it comes to choosing a programmatic provider, advertisers are also split. While a majority of those surveyed have used agency trading desks (65 percent) and demand side platforms (61 percent) to purchase programmatic, the preferred programmatic providers are publishers (36 percent). They're followed by trading desks (23 percent), and DSPs (21 percent). This is obviously beneficial as advertisers can deal directly with suppliers, cutting out both the middle man as well as the uncertainty that comes with not knowing exactly where the ads you have purchased will actually be displayed.

The important criteria for choosing a premium programmatic (preferred or private auction deals negotiated with a publisher) partner is also viewed quite differently, with respondents citing audience insight and data (91 percent), ease of use (90 percent), credible metrics (87 percent), and transparency (87 percent) as some of the most important factors.

Our research also revealed that while agencies and marketers are both engaging more and more in premium programmatic sector, they are doing so for different reasons and benefits. For example, while agencies are more drawn to premium programmatic by the increased efficiencies involved with purchasing premium inventory (46 percent) and the removal of the "middle man" from the process (34 percent), marketers, on the other hand, cited less audience targeting waste (45 percent), and the reduction of advertising costs (38 percent) as the most attractive benefits of premium programmatic. However, although agencies and marketers did offer contrasting views on the most attractive outcomes of premium programmatic, a similar percentage of agency members and marketers surveyed cited more accurate audience targeting (28 percent versus 26 percent) as one of the most attractive premium programmatic benefits for them.

While growth has been astronomical, and the promise of premium programmatic is quite high, advertisers, agencies, and marketers alike are also cognizant of several challenges that still exist within the space. A lack of premium inventory (54 percent) and inadequate targeting to preferred editorial brands and audiences (37 percent) are among the biggest bumps in the road for premium programmatic. Our research also showed that a at least a quarter of advertisers are mindful and weary of a lack of human interaction (30 percent) and transparency (25 percent) that exists, meaning there is certainly room for growth (advertising fraud has become a huge buzz phrase, lately, exacerbating the transparency and lack of human interaction issues).

In the end, programmatic is exploding in adoption and spend. However, we have yet to reach maturity or complete consensus on optimal use cases and benefits. That will come with time, as the market continues to sign on. In the meantime, though, we have a good sense of the possible direction and can execute accordingly.

Thursday, August 28th, 2014

PARTNER CONTENT

This story is part of a series in partnership with MediaNext sponsor The Media Briefing.

The Washington Post's new owner Jeff Bezos is one of the most high-profile and successful tech entrepreneurs around, but the newspaper's attempts to work out how to build a media company that works online predates the Amazon boss's intervention.

Washington Post chief information officer and vice president, digital product development Shailesh Prakash has been at the heart of that process for three years, under former boss Don Graham and Bezos.

He tells TheMediaBriefing that predicting what, or more importantly when, new technology is going to have an impact on your business is nigh on impossible to get right all the time. But that doesn't mean you can't make sure you ride the wave effectively:

"Often it’s quite hard to work out what is a fad and what is here to stay. It’s very easy to predict the future, but it’s very difficult to predict when that future will arrive. Some will take hold and others will take years and years. You’ll have spent money without any return."

"I don’t think there is anyway other than to be completely open to continuously experiment. There isn’t a science to it. It’s much more about art."

As an example of projects that haven't taken off, Prakash cites The Washington Post's experiments in long-form online video targeted at web-connected TVs, which were relatively easy to build but have so far failed to take off with consumers, and its ongoing experiments with personalisation, which are not yet quite right for its audience.

Prakash says that key to creating that environment where this kind of experimentation is possible is making sure that the budget for trying new things is set out early on:

"Have an explicit conversation with the leadership team to draw the lines on a yearly basis of the bucket of money you want to spend on new tech and experimentation. I say that because if you get an upfront agreement it is vigorous debate, but you commit. If you go half-way through the year, by that time everyone’s kind of nervous."

Prakash says he has been lucky in that during his time at the Post under both under Bezos and Graham he has always been able to earmark more than half his budget for experimentation.

However, he believes all media companies can benefit from at least working out how much room they have to manoeuvre, and trying to free up funds from "bread and butter" technology systems – the ongoing tech work – to provide more funding for new projects:

"CIOs and CTOs should take a careful look at their existing bread and butter operation and see how much efficiency can wring out. At a lot of media and retail companies there is a process of removing products and processes that are no longer necessary."

"Folks are good at building things, they are very poor at stopping things. It can yield significant dollars to invest in innovation and that is something I would do very seriously."

When to think about money

There is of course the tricky issue of when you bring in the topic of monetisation to the development process. Few media businesses have the same leeway as Silicon Valley startups and giants to mess about without a clear vision for making money.

Prakash says the Washington Post takes a twin approach. The first involves making sure sales teams are embedded in the development of most projects from the start:

"The number one goal is to have embedded designers and engineers in the sales team. They have a very strong voice in the design of any product we are trying to develop."

"Dedicating designers and engineers to the chief revenue officer of the company gives him the freedom and makes him an equal partner."

However, there will also be projects that have no immediate clear path to making money that are nevertheless necessary. Prakash says that when it comes to these, the most important thing is to be upfront:

"We do our very best if we are not going to go after monetisation, to explicitly say that. That helps us all to have visibility of the money, and it makes us a bit more judicious about when we do it."

"The dangerous approach is just doing stuff and informally saying I haven’t figured that out yet."

Experimentation both on the design and content sides of the Washington Post business are having some impact. Prakash says the Washington Post's recent widening of focus to include more national and international news, as well as more content for verticals such as style and cooking, have driven traffic to near record levels this summer during what is traditionally a quiet period.

But Prakash is pretty clear the company, and other media businesses, need to keep going or risk potentialy catastrophic implications of falling behind:

"Five years ago there was no iPad. Things come very, very fast. If you want to be a fast follower, typically there is no fast follower. Someone (leading) takes a very large part of the pie. Just look at Amazon."

"To not experiment is not an option."

Shailesh will be speaking on day one of Monetising Media on September 30 in London. You can find the agenda and speaker lineup for the event, here.

Tuesday, August 12th, 2014

BY MICHAEL RONDON

U.S. News & World Report struggled to regain its footing after the recession as print advertisers, readers and eventually the magazine itself, disappeared.

The brand known for its rankings of major consumer products like colleges, cars and health care, is recommitting to consumer advice in the digital age though. U.S. News has launched four tools in the past year aimed at matching potential purchasers with the right suppliers. It also announced an expansion of the effort on Thursday.

U.S. News has launched a Money Products team—a vertical aimed at helping consumers with financial planning, similar to its Health Products team started last year—and hired Kim Heneghan to be general manager of the group. Heneghan had been the online general manager for Hanley Wood, a B2B publisher in the construction and real estate markets. Kim Castro, editorial lead behind the consumer advice group was also promoted to executive editor of the division.

"We're building on what we've been doing well for the last decade and the Internet has been great for our expansion into new areas of consumer advice," says Bill Holiber, CEO of U.S. News. "Users are highly engaged with our consumer advice journalism and that sort of engagement is attractive to a broad range of advertisers."

Interactive tools like the Doctor Finder and [Financial] Advisor Finder merge user-friendly utility with about a million new pages of information. Those pages, sorted by areas of expertise and geography, offer highly qualified ad inventory. And they're drawing eyeballs. Overall monthly uniques are up more than 20 percent over last year, now sitting at 25 million.

"We have a very motivated audience," Holiber says. "They are educated, in-market consumers looking to make important decisions, and that pairs nicely with the needs of various kinds of companies."

Consumer advice isn't a new facet of consumer-facing media—especially in the age of personal electronics—but comprehensive data and information services like U.S. News's supplier databases are. They've traditionally been small, but profitable staples of B2B media, generating margins upwards of 19 percent, according to a Folio: survey from earlier this year.

They're foreign territory for most consumer publishers though, and Holiber believes it's a missed opportunity.

"A lot of consumer media companies just don't get the value of data-rich information, they tend to be too news and text driven," he says. "We've been fortunate that data has been part of the company's DNA since we were founded 80 years ago. We started the Best College rankings 30 years ago, and that has provided the basis on which we've built this large and growing franchise. We've learned a lot from the B2B world, to the point where we are now producing our own B2B data products, including ones for colleges and hospitals."

Recent Blog Posts